Faculty and Staff Appeals

Thank you for taking the time to assist a student with a financial aid appeal. There are many circumstances that may have an impact on the financial aid a student was offered or their eligibility for financial aid. Please review the corresponding information to learn more about each appeal.

There are a few different scenarios where a student might be interested or asked to complete this appeal.

Here are a few examples:

- A student is in overaward status (meaning, their total aid offered/received is greater than their cost of attendance). Our office may give a student an opportunity to complete this appeal in order to clear the overaward and allow the student to keep all of their offered financial aid.

- A student would like additional financial aid for various educational related expenses (grants, loans, etc.) and in order to prevent an overaward (see above) would need to increase their cost of attendance.

The COA Appeal form is available to students after they have contacted the Office of Scholarships and Financial Aid with the request. Once the request has been approved by our office, a To Do List item, which will include the link to the form, will be added to their UAccess Student Center To Do List. The student will need to complete this form and submit all required documentation online via the provided link. We do not accept paper copies of the appeal form or supporting documentation.

If a student indicates their educational expenses are more than the University of Arizona estimated cost of attendance, they will need to provide official documentation and explanation of these expenses. Below is a list of what specific documentation is acceptable for each expense category a student may be interested in increasing.

A student is given an estimated budget amount for a variety of educational expenses for the year. Learn more about how these estimates are created here. When a student exceeds these estimates, we may be able to increase their COA based on the documentation provided. At the bottom of this document is a table of the University of Arizona's estimated budget for each category for your review.

- Proof of Rent/Mortgage: Submit expenses for the student only.

- If married or living with roommates, the cost is split evenly between contributing household members.

- Additional expenses cannot be added if a student lives in military housing.

- Proof of Utilities: Utility statements should be submitted for the previous 3 months. The student’s share is then averaged to calculate expenses.

- Food: Not currently included on the COA Appeal form. However, the student may submit documentation within the Medical Category (ex. a note from a dietitian or DRC with estimated monthly costs) if the higher food expenses are due to a medical condition.

- Childcare/Dependent Care: Documentation may include a personal statement from caregiver, daycare bills, university daycare form, etc. The student can only include costs that accrue during the time of class.

- Books: Acceptable documentation includes itemized receipts of school books and supplies (art students purchasing software or writing utensils, etc.). It is unacceptable to provide screenshots of bookstore charges or receipts without an itemized list (Bursars receipts included).

- Transportation

- Acceptable:

- Documentation (such as Google Maps) of the route driven to and from school must be provided. Appeals for mileage will be approved in cases where the mileage expenditure (based on the $0.445 per mile, the # of days per week, and the number of weeks in the semester that the commute is made) exceeds the standard COA budget.

- Major vehicle repair (need itemized list in student’s name).

- Flight costs to home residence.

- Unacceptable:

- Car payments

- Routine Maintenance (oil changes, air filters, batteries etc.)

- Acceptable:

- Cell Phone: Acceptable documentation is the cell phone provider bill which must be in the student’s name AND must indicate only their portion of the bill.

- Medical Insurance: Student must provide an insurance bill in the student’s name.

- Dependent Students: Can submit only if they are not covered within their parent’s policy

- Out of Pocket Medical Expenses: These are not included in a student’s budget. Students can include both one-time expenses (an eye doctor visit with new glasses) AND re-occurring expenses (medical treatments). Bills which indicate the “patient’s responsibility” should be provided.

- Computer: A student may request funding for a computer one time per academic career. We can accept a billing statement or an estimated print out. This can include hardware/software programs. Special documentation from their department is required for students who have computer expenses above $3000.

- Professional Conference Attendance: This is for graduate students only. Special documentation from the student’s department is needed for travel and hotel expenses. Acceptable documentation includes a receipt or print-out of conference registration fees, airline and hotel receipts.

| CATEGORY | UGRD STANDARD (PER MONTH) | GRAD STANDARD (PER MONTH) |

|---|---|---|

| Rent | $767 | $1,122 |

| Utilities | $150 | $224 |

| Childcare/Dependent Care | $0 | $0 |

| Books | $300 (per term) | $300 (per term) |

| Transportation | $261 | $556 |

| Cell Phone | $86 | $94 |

| Medical Insurance | $0 | $0 |

| Medical (Out of Pocket) | $0 | $0 |

| Computer | $0 (max $3,000) | $0 (max $3,000) |

| Conference | Not Available | $0 |

For more information, visit our Appeals Policy page.

On the FAFSA, a student’s Student Aid Index (SAI) is a number used to determine how much financial aid a student is eligible to receive. A student’s SAI is calculated using the household taxed and untaxed income, assets, and benefits (such as unemployment or Social Security), and family size.

There are a few different scenarios where a student might be interested in completing this form.

- If a student’s, spouse’s, parent’s, or household’s financial situation changes due to special circumstances after filing the FAFSA, a student may request to submit a FAFSA Data Appeal. The following financial situations can be considered special circumstances:

- Loss of employment

- Reduction in earnings

- Paid medical costs not covered by insurance

- Death of a parent

- The following are not considered eligible special circumstances:

- Pending reduction in income due to fluctuating commissions or consumer debt

- Refusal of a parent to provide financial support to the student

Note: If the student already has an SAI of -1500 on their FAFSA, they are not eligible to complete this form, as the FAFSA has already calculated that they demonstrate the highest level of financial need.

The FAFSA Data Appeal form is available to students after they have contacted the Office of Scholarships and Financial Aid with the request. Once the request has been approved by our office, a To Do List item, which will include the link to the form, will be added to their UAccess Student Center To Do List. The student will need to complete this form and submit all required documentation online via the provided link. We do not accept paper copies of the appeal form or supporting documentation.

The form has “skip logic” so, depending on how the student answers questions on the appeal, different pieces of the form appear.

If a student indicates their household’s financial situation has changed due to special circumstances after filing the FAFSA, they will need to provide official documentation and an explanation of these circumstances. Below is a list of what specific documentation is acceptable for each special circumstances category.

Documents can be from the 12 months prior to the current academic year.

Students can expect to be contacted with the decision via their University of Arizona email account within 4 weeks of the appeal submission.

| SPECIAL CIRCUMSTANCE | TYPES OF DOCUMENTATION REQUIRED | CIRCUMSTANCES ALLOWED FOR |

|---|---|---|

| Unemployment | o A copy of employment separation letter, including verification of severance pay or retirement benefits (or the lack thereof), o Or a copy of a letter or statement establishing the amount of eligibility for unemployment benefits; o Or copies of recent W2s and 1040 Tax Form or Tax Return Transcript if their current income is less than their previous year’s income. | Student, Spouse, Parents |

| Disability or Injury | o Copies of statement(s) reflecting eligibility for benefits, monthly amount received and start and end dates of payments; o Or copies of current W2s and 1040 Tax Form or Tax Return Transcript if their current income is less than their previous year’s income. | Student, Spouse, Parents |

| Loss of Income | o A copy of termination notice of other income (e.g., social security benefits, trust payments, alimony, child support). o If currently employed, submit last 2 paycheck stubs | Student, Spouse, Parents |

| Death of Spouse or Parent | o Required to provide the date of the event; o And copies of supporting documentation or certificates. | Spouse or Parents |

| Report of One-Time Income | o Required to provide a copy of your previous year’s 1099-R or other financial statement of one-time income (e.g., early IRA distribution, conversions and rollovers) o Prior, prior year tax forms o Prior year tax forms | Student, Spouse, Parents |

| Medical Treatment | Copy of the statement(s) from the insurance provider, pharmacy or medical facilities, stipulating the amount of the medical expenses paid that were not covered by insurance. | Student, Spouse, Parent, Household |

| Private Education (K-12) | Copy of tuition statement that includes total tuition cost as well as any financial assistance received. | Student Siblings (if Dependent), Student children (if Independent) |

| Tax Liens | Statement from the Internal Revenue Service and/or State Tax Board indicating monthly payment amount on back taxes owed. | Student, Spouse, or Parents |

| Court Ordered Payments | Receipt of payments | Student, Spouse, or Parents |

| Additional students in the family’s household with college educational expenses | Educational expense bills which include documentation of out of pocket expenses and financial aid awarded (check payment, web payment, receipt, the household member’s financial aid offer letter) | Parents (if Dependent) Student and siblings of the student if included the student’s family or Children (if Independent) |

For more information visit our Appeals Policy page.

A student’s dependency status determines whose information they must report on the Free Application for Federal Student Aid (FAFSA). A student who is under age 24 is considered a dependent for federal financial aid purposes and must include their parental data on the FAFSA. If a student has extenuating special circumstances (i.e. abandonment or abuse), they may qualify for a Dependency Override.

Qualifying Dependency Override Special Circumstances:

- Abandonment by parents

- An abusive family environment that threatens the student's health or safety

- The student being unable to locate their parents

- In the above cases a dependency override might be warranted. If the student believes that they have other unusual circumstances that do not fall under the qualifying circumstances above, then they will be required to explain their special circumstances and provide the required documentation.

The conditions listed below, singly or in combination, do not qualify as special circumstances meriting a dependency override:

- Parents refuse to contribute to the student's education.

- Parents are unwilling to provide information on the FAFSA or for verification. (*Please see Other Important Information below.)

- Parents do not claim the student as a dependent for income tax purposes.

- Student demonstrates total self-sufficiency.

The DO Appeal form is available to students after they have contacted the Office of Scholarships and Financial Aid with the request. Once the request has been approved by our office, a To Do List item, which will include the link to the form, will be added to their UAccess Student Center To Do List. The student will need to complete this form and submit all required documentation online via the provided link. We do not accept paper copies of the appeal form or supporting documentation.

- The student must submit a personal statement

- The student must submit at least two letters or official documents from teachers, counselors, a medical authority, a government authority, etc.

- The documentation must support and include the reason for the unusual circumstances of the student.

If the student does not have special circumstances that would qualify for a dependency override, they must correct their FAFSA to include their parent’s information.

- If their parent(s) refuse to include their information on the FAFSA, they can be directed to review the Parental Data Override Form to potentially qualify for Federal Direct Unsubsidized Loans only.

A student may qualify as an Independent student if the student is under 24 years old and

- is married,

- has dependents (and provides more than 50% of support),

- is an orphan,

- is a veteran or active duty member of the US Armed Forces.

Please encourage the student to answer the corresponding dependency status questions on the FAFSA appropriately. They may also be required to verify their status with the school.

Note: The student’s appeal must be resubmitted for review every academic year to continue as an approved Independent student.

For more information, visit our Appeals Policy page.

Satisfactory Academic Progress (SAP) Appeal

The Office of Scholarships and Financial Aid monitors financial aid students after every semester (Fall, Spring, Summer) for successful completion of SAP standards. The SAP appeal process provides an opportunity to request suspension be lifted for one semester while the student works towards improving academic progress.

The Office of Scholarships & Financial Aid (OSFA) monitors students at the end of every semester to determine if they have met SAP for all three SAP standards. If a student is unable to meet one or more of the SAP standards, they may lose their federal and some institutional financial aid eligibility.

- After the first time a student fails SAP, they are placed in a “Warning” status. This means the student is still eligible to receive federal financial aid for the subsequent term without the need to submit a SAP appeal.

- Students who fail to meet the Maximum Timeframe Standard will be placed in “Financial Aid Suspended Status” the first time they fail that standard, there is no “Financial Aid Warning Status” for this SAP standard.

- The second time a student fails SAP, they move from “Warning” status to “Suspension”. This means the student has lost their eligibility for federal financial aid.

In order to be considered federal and institutional financial aid again, a student in “Suspension” status must either:

- Have an approved SAP Appeal on file or

- Pay out of pocket until the student is once again meeting SAP standards and regains federal financial aid eligibility

- Please note, this option may take the student one or more semesters, depending on how severely they were not meeting the SAP standard(s) and students who have failed for Maximum Timeframe cannot use this option. They must have an approved SAP appeal on file in order to continue receiving financial aid.

Students are notified if they have lost federal financial aid eligibility and have the option to complete the SAP appeal via their Catmail and a new To Do List item on UAccess Student Services Center.

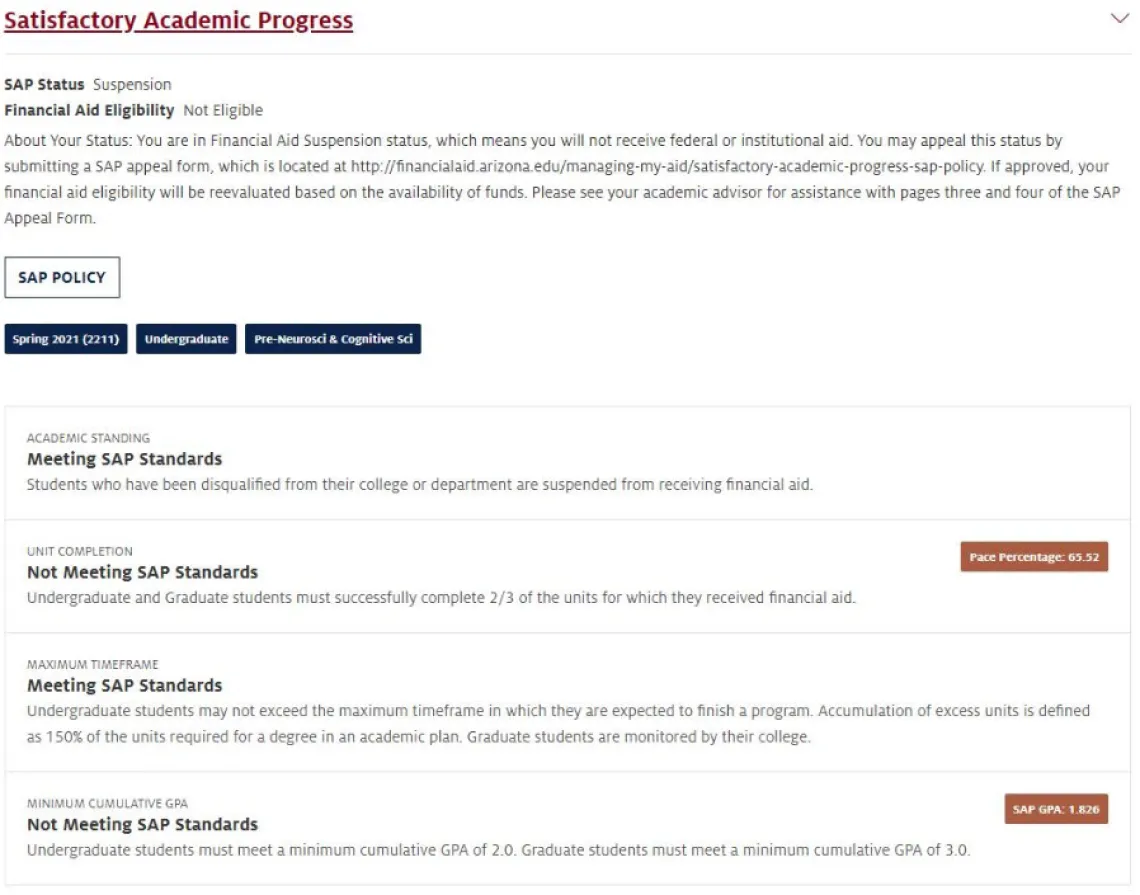

Students can review their SAP Status by navigating to the Financial Aid Summary page and clicking the Satisfactory Academic Progress link near the bottom of the page.

Please note that a student is not required to submit a SAP Appeal but it is an option available to them if they have experienced extenuating circumstances that contributed to their inability to meet SAP standards.

The SAP Appeal form can be found on our SAP Policy page.

Please note that sometimes the appeal may be available for multiple semesters. Students would complete the appeal for the term they are intending to receive financial aid for.

For example, Wilbur was notified that he not-meeting SAP after the completion of the spring term and was registered for Arizona summer courses. Wilbur would need to complete a Summer SAP Appeal to receive federal financial aid for the summer semester.

SAP Appeal deadlines for each term (including summer) may vary. In general, federal regulations require that we receive the appeal, process the appeal and award the student prior to the student’s last date enrollment in the term. We ask that students submit their SAP appeal to our office at least 10 days prior to the last day of the term or their enrollment so we have time to review, process and award. To review exact deadlines for a particular academic year, you can find details on our SAP Policy page.

Please keep in mind that a student intending to submit the SAP appeal will not be able to receive their financial aid funds until a SAP Appeal has been received, reviewed and approved by our office. Please continue to encourage your students to meet with their academic advisor and complete their form as soon as they have been alerted by our office that they are not meeting SAP standards.

Within the SAP appeal form, students will be prompted to answer a set of questions to address the extenuating circumstances that prevented them from meeting SAP standards in the past and what steps they have taken/will take to ensure that they will be academically successful in the future. Students are not required to include supporting documentation outside of the completed appeal, but may submit additional documentation for our review if they choose to do so.

Advisors will also have an opportunity within the form to add information they feel is helpful for OSFA to consider. Advisors can use this space to explain the student’s future plan for success and specific recommendations they have for the student.

For those not meeting GPA and/or PACE

A student who is suspended for GPA and/or PACE and has an approved appeal will be given probation requirements they must meet within that semester. At the end of the semester, our office will review the student’s academic progress to determine if they have met those conditions. If so, their probation status will roll into the next semester (fall, spring, summer) and they will not be required to submit an additional SAP appeal.

Standard Probationary Status Requirements:

2.0 undergraduate semester GPA or 3.0 graduate semester GPA AND/OR

67% pace completion

*Please note, these are minimum requirements and OSFA may require additional/higher requirements be met for a student to remain on a probationary status.

For those not meeting Maximum Timeframe

A student who is suspended for Maximum Timeframe (and GPA and/or Pace) will be required to submit a Maximum Timeframe Academic Plan SAP Appeal Form. They will be required to meet with their Academic Advisor and compile a list of the courses that are needed in order to complete the graduation requirements of their degree(s).

If their Maximum Timeframe Academic Plan SAP Appeal is approved, at the end of the following semester, our office will review what coursework the student took during that semester to confirm that only the courses listed on the previously submitted Maximum Timeframe Academic Plan were taken. If they have met those conditions, their probation status will roll into the next semester (fall, spring, summer) and they will not be required to submit an additional SAP appeal.

In general, the review and processing time for any document submitted to OSFA is approximately 2 to 3 weeks, but varies based on the time of year and number of appeals received by our office. If a student has not yet been offered financial aid for the semester in which the appeal was approved, it can take up to 2 weeks, after the SAP Appeal is approved, for the student to be offered financial aid.

We understand that this process involves not only the student and our office but also partners with our academic advisors. OSFA will notify a student via their Catmail if their appeal is not complete or if they need to make another appointment with their academic advisor to make any corrections to their SAP Appeal. The email they receive details any corrections that have been requested.

1. The incorrect SAP standard is selected or only one standard selected (in the case that a student is not meeting two or more standards) on the form. Students can view which SAP standards they are not meeting in the UAccess Student Center.

The following example shows what the UAccess Student Center displays when a student is not meeting two SAP standards.

2. Students do not answer all the questions in the personal statement section. Students should be honest in their personal statements, pinpointing what was holding them back and address how they plan to resolve the barrier in the future.

3. Student submits the incorrect form for the semester they are looking to receive financial aid. For example, submitting a Summer form when the student is not enrolled in Summer classes.

4. Student or advisor signature is missing on the form. A complete form includes both the student and advisor signature.

5. Student submits the incorrect appeal form. Please review the information below to determine which appeal is needed. A student should only ever submit one SAP appeal form.

- Students not meeting the Maximum Timeframe (and GPA and/or Pace) standard - Must complete the SAP Appeal Maximum Timeframe Academic Plan Form.

- Students not meeting GPA and/or Pace standard(s) only - Must complete the SAP Appeal form.