How to Act on your Denied Parent PLUS Loan

The U.S. Department of Education will notify the parent borrower if they are denied the Federal Direct Parent PLUS Loan. The parent may still be eligible to receive a Direct PLUS Loan or have other options available.

When a parent’s PLUS loan application is denied, there are options available that, if chosen, could offer the parent or student access to loan funding to help with educational expenses.

The parent borrower or student may elect to take action on one of the following options:

You have the right to appeal an adverse credit decision if you think it was made in error or if the decision was based on information that is now out of date.

- Navigate to studentaid.gov appeals page and log in to the parent account.

- Follow the steps outlined to submit your appeal, providing supporting documentation where needed.

To file an appeal, you’ll also be to complete PLUS credit counseling.

Note: Only one option may be selected. Taking action on more than one options will cause processing delays and issues.

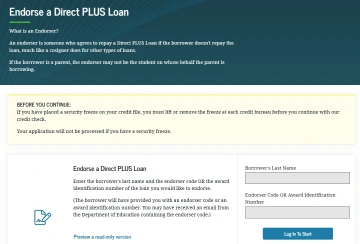

An endorser acts as a co-signer and must be someone who does not have adverse credit and is willing to pay back the parent PLUS loan if you are not able to. Your student is not eligible to serve as the endorser.

Your selected endorser can complete the Endorser Addendum online using your last name and the Endorser Code.

- Navigate to the Endorser Addendum on studentaid.gov.

- The endorser will log in using either:

- The Borrower's last name (name of the parent who applied for and was denied the loan) and the Endorser Code that was provided to you by the parent borrower.

- The Award Identification Number provided to you by the parent borrower.

- Follow the steps outlined to apply.

Note: If you opt to obtain an endorser, the parent borrower will still be required to complete PLUS credit counseling and a parent PLUS Master Promissory Note (MPN). For more information visit studentaid.gov.

Note: Only one option may be selected. Taking action on more than one options will cause processing delays and issues.

Students are limited in how much they can receive each academic year in student loans, however, in cases where a parent PLUS loan is denied, we may be able to offer your student an additional unsubsidized student loan. This option only applies if both (if applicable) parents have been denied the Parent PLUS Loan.

The unsubsidized loan will not be offered for the same amount as the Parent PLUS Loan. Often the student is eligible for significantly less meaning your student may still have a large gap between their costs and funding available.

The amount of this additional loan will be based on the student’s grade level and other offered financial aid:

- First Year and Sophomores can receive up to $4,000 for the academic year

- Junior and Seniors can receive up to $5,000 for the academic year

Contact a member of our AskAid team to cancel the denied parent PLUS loan and be offered the additional unsubsidized loan.

To request the additional unsubsidized loan, the student can contact a member of our AskAid Team:

- The student should submit an email to OSFA

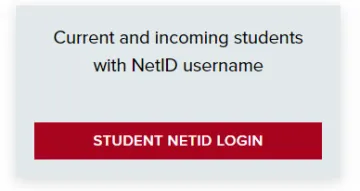

- Students will be required to login using their Net ID login information

3. In the body of the message, the should provide their name and 8-digit Student ID (SID) in additional to their request for additional unsubsidized loan due to a denied parent PLUS Loan. Then, submit your email.

Note: Only one option may be selected. Taking action on more than one options will cause processing delays and issues.